Delivering a Realistic, Financeable First Stage Project to Unlock District Scale Production Growth

Asiamet Resources Limited (AIM: ARS) is pleased to announce the completion of the Optimised Feasibility Study ("OFS") for BKM Stage 1, the first phase of development at the Company's 100%-owned BKM Copper Project ("BKM" or "the Project") in Central Kalimantan, Indonesia.

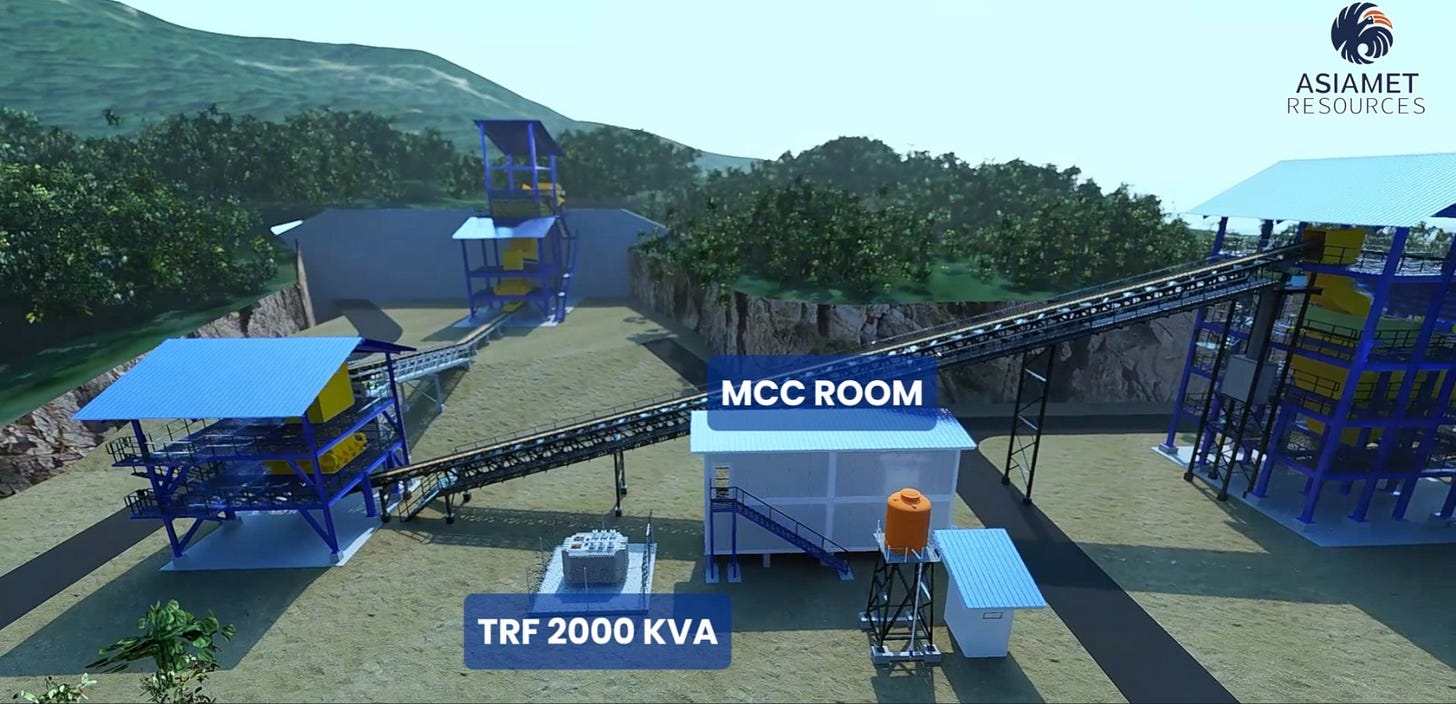

BKM Stage 1 has been engineered as a simplified, lower-capex, staged-build heap-leach operation focused on near-surface, higher-grade ore. It is designed to deliver LME Grade A copper cathode which is fully compliant with Indonesia's downstream processing requirements and aligns with national development priorities.

With targeted average annual production of approximately 10,000 tonnes of copper cathode, BKM Stage 1 offers an efficient entry into production at a time when copper deficits are expected to deepen significantly going forward.

The completed OFS delivers optimised engineering designs from our study partners Rexline Engineering, BGRIMM Technology, Mineria & Servicios, Claveria Consulting and Buma Infrastructure. The study also reflects direct feedback from prospective lenders, updated permitting schedule and robust execution planning incorporating the latest royalty and fiscal framework established by the Government of Indonesia.

The study establishes BKM Stage 1 as a technically robust, financeable project with highly attractive economics and is a strategic first step in laying the foundations for long-term value creation across the broader KSK Contract of Work. With key infrastructure and execution significantly de-risked, the Company sees substantial upside potential from the immediately adjacent BKZ base and precious metals deposit, BKM primary sulphide resource, high-grade copper drill hits at BKS, and multiple additional targets across the KSK licence area.

Key Highlights:

Annual copper cathode production of approximately 10k tonnes with a ~13 year mine life

Life-of-mine revenues of US$1.192 billion and EBITDA of US$612.2 million1

Initial capital cost of US$178.4 million, including US$11.1 million (7.6%) growth allowance and US$21.8

million (~ 13.9%) contingency

Post-tax NPV81 of US$122.4 million, post-tax IRR1 of 17.7%, and payback period of 4.5 years

Life-of-mine production of 124,022 tonnes of LME Grade A copper cathode

Low strip ratio of 0.77:1, Life-of-Mine C1 costs of US$1.79/lb and AISC of US$2.37/lb

Development and Strategic Positioning

Execution-Ready: Compact site layout and proven technology significantly reduce construction and operational risks.

Lender Engagement Ready: Updated engineering and financials; ITE review process near completion.

Strategic Engagement Underway: OFS unlocks structured engagement with a comprehensive list of parties interested in strategic investment and/or product offtake

Platform for Growth: BKM Stage 1 establishes foundational infrastructure to unlock significant upside across the KSK Contract of Work, including the remaining 80kt of un-leached copper in spent heap leach ore, 245kt in-situ sulphide copper resource at BKM and the high-grade BKZ polymetallic deposit.

Leveraged to Positive Global Copper Outlook: NPV8 of US$142 million and IRR of 18.9% using a $4.52/lb LT price (broker consensus + 5%), and NPV8 of US$202 million and IRR of 22.9% using a $5.00/lb LT price (highest broker price), highlighting the strong leverage of BKM Stage 1 to an uplift in copper price.

BKM Project Sensitivity to Copper Price

Advancing Financing and Strategic Process

With the OFS complete, Asiamet will initiate formal engagements with its prospective lenders and update data rooms for a structured engagement process with interested parties. These include commodity traders seeking offtake, smelter-linked entities, and regional industrial operators. Many of these groups, some of which are already under NDA, have been awaiting completion of the updated study to be released prior to commencing formal due diligence

Darryn McClelland, Asiamet’s Chief Executive Officer, commented:

"Completing the BKM Optimised Feasibility Study marks a major milestone on our path towards becoming a copper producer. The optimised study balances scale, production rate and mine life - qualities we believe will attract strong interest from local and international lenders.

The study delivers a technically robust, development-ready copper project featuring updated capital estimates, a compact execution footprint, and alignment with prospective lender requirements. The simplified development approach materially reduces execution risk while retaining strong leverage to copper price upside.

Importantly, BKM Stage 1 is just the beginning. It establishes a solid platform for unlocking long-term growth across the broader KSK licence area, including the development of the BKM primary sulphide resource and the adjacent high-grade BKZ polymetallic base and precious metals deposit. We believe the BKM development strategy will underpin Asiamet's ability to grow a multi-asset, long-life copper operation in one of Asia's most strategic growth corridors.

Our immediate focus now shifts to formal financing discussions and structured engagement with a growing list of interested parties."

Tony Manini, Asiamet's Executive Chairman, commented:

"With this study, Asiamet has delivered a simplified and financeable first-phase project that meets the realities of today's market while laying the foundation for something much larger. BKM Stage 1 is the enabler - a practical starting point that brings Asiamet to the threshold of production and unlocks future growth across a highly prospective copper district.

This is a pivotal milestone for Asiamet. With financing preparations now underway and interest from multiple well-qualified parties, we are focused on delivering the best path forward for shareholders - whether through development, partnership, or a strategic transaction."

Next Steps:

· Finalisation of Independent Technical Expert (ITE) review.

· Formal launch of structured engagement with lenders and strategic investors.

· Appointment of Project Director to lead the BKM project engineering and construction.

· Early engagement of construction contractor/s.

· Finalisation of key permitting activities.

· Preparation for detailed engineering design and project execution.

· Targeting a Final Investment Decision (FID).

A copy of the 2025 BKM Feasibility Study Executive Summary is available on the Company's website at www.asiametresouces.com and appended to this announcement via the following link https://asiametresources.com/technical-reports/

Investor Presentation via Investor Meet Company:

ASIAMET RESOURCES LIMITED is pleased to announce that Tony Manini Executive Chairman and Darryn McClelland CEO will provide a live presentation via Investor Meet Company on Friday 9 May 2025, 08:00 BST.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 08 May 2025, 09:00 BST, or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add to meet ASIAMET RESOURCES LIMITED via:

https://www.investormeetcompany.com/asiamet-resources-limited/register-investor